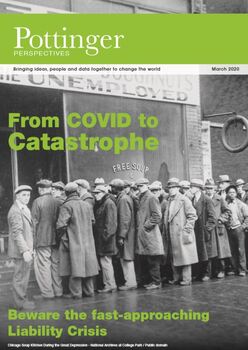

Too much attention has been focused on filling the income gap that many people and companies now face and too little on reducing expenses and liabilities. As a result, there is a growing risk that the current health crisis and economic downturn turns into a massive liability crisis, triggering a Second Great Depression in many developed economies. Let me explain! >>>  Australia is one of the strongest economies in the world. We are rich not simply in our natural resources, but also in our magnificent environment, pristine agricultural supply chain, extraordinary indigenous heritage and resourceful and creative people. Australians deserve much better than an age of ignorance. We need leaders who put innovation, entrepreneurship and long-term thinking ahead of sound-bite opportunism – leaders who trust in independent analysis and objective decision-making, not party-political rhetoric. Our editorial provides further background (click the image above or here). We also invite you to browse through the Pottinger Manifesto here, and add your voice to our movement to help deliver an even stronger Australia. If you like what we're saying, please share so that our collective message is amplified as loudly as possible!  Many countries and industry sectors are heading into the most turbulent environment seen in the last century. Three simultaneous industrial revolutions, dramatic increases in competition, huge fiscal imbalances, growing geopolitical tensions and a fractured social contract are combining to create a veritable smorgasbord of risk and uncertainty. The hurricane is gathering force and stormy weather lies ahead. Yet these same factors also imply that this will be the best possible environment for strong businesses to outperform. How can you make the most of this opportunity? Read on >>  There is a cold bite in the air. It aches and alerts in equal measure. Despite the chill, it is a sunny day at altitude, and very quiet. My skis are perched on a ledge at the start of a run with a characteristically threatening name. There are only two other adventurers in sight – one glides effortlessly in the distance having conquered today’s challenge. The other sits entangled in a mess part way down the hill. One, two, three - - - go. Read on... for John Sheehy's take on five snowsports lessons for your business.  The world’s greatest economies have been built on international trade and investment. From the Greek and Roman Empires of ancient times to the Ottoman Empire and British Empire, global commerce has created huge wealth and unparalleled economic advantage. Meanwhile, every century or so, technological development and political decision-making have combined to catalyse significant shifts in the global balance of power. In the UK, this included the advent of steam power, mechanisation of manufacturing and adoption of steel-hulled ships for transport during Britain’s industrial revolution. Scientific and industrial innovation thus enabled the creation of the largest, richest and most powerful empire of all time. Much of that technology and experience was exported to the United States, enabling the construction of the railroads and creation of the United States of America, creating the military, financial and technology powerhouse of the 20th century. The same is true for the world’s greatest commercial enterprises. The world’s first companies – the Dutch and British East India companies – were formed around 1600 to pursue international trade. At their peak, they both owned merchant navies with massively more ships than any country has today. Today, the five largest listed companies in the US are Amazon, Apple, Facebook, Google and Microsoft, three of which are barely twenty years old. Importantly, all have built their success on innovative new technologies, and all five have businesses that are global in nature. Importantly, these five companies alone have accounted for a material part of overall stock-market growth in the US since 2000. Collectively, they have a market value of $3.5 trillion, more than the entire capitalisation of Australia’s Stock Exchange. So, it was with great interest that I attended the Belt & Road Trade and Investment Forum in Beijing last week. Read on...  We have a leadership crisis in Australia and it is hurting our nation on the world stage. In our latest Pottinger Perspectives piece, Nigel Lake revisits the startling lack of ambition in certain corners of Australia’s public and private sectors. Innovation, technology, digitisation, renewable energy and so on – the list of 2017 themes of disruption goes on, but the structural, political and personal inhibitors to Australia’s next era of growth – one that is not dependent on the old economy principles of our past successes – are standing in the way. We invite Australia’s leaders to stand up from the crowded mass of the status quo and make bigger, bolder and braver decisions.  I read with some alarm about the BA plane bound for Dusseldorf that ended up in Edinburgh by mistake. But - I have a confession. I made a similar mistake once myself one Easter! We were trying to sail from Jersey to Guernsey. A short while into the trip, it seemed that the boat’s compass was pointing in the wrong direction. As time went by, the error increased… Those that know the waters will understand the very real risks involved, particularly given the icy water in the English Channel at Easter time. In retrospect, however, it for some good life and business lessons! Read: The Accidental Circumnavigation of Sark.

We’ve all heard of the concept of the bucket list – the things that you really want to do before you die. But have you ever thought of making a bucket list for your company? The cold hard truth is that very nearly all organisations will meet with the corporate undertakers in the end. As an example, the world’s first company, the Dutch East India company, was founded in 1602. At its peak, it employed nearly a million Europeans. Once richer and more powerful than most nations, it eventually died an ignominious death, appointing receivers in 1800. And at the other extreme, the large majority of small businesses and start-ups fail, the majority of them before their tenth birthday. The last two decades have seen the spectacular overnight insolvencies of some of the largest businesses in the world. Some, such as Enron and Bear Stearns, were simply allowed to die a natural death. Others, including some of the largest American banks, were shepherded into the arms of larger, stronger organisations, allowing at least parts of the business to survive. In every case, those who were involved in the oversight and management of the companies in question will surely have had regrets as the new landlords or administrators walked in the door. And for many of the employees, the impact was profound, including lost jobs, lost investments, unexpected career changes and worse. Read on...  There has been extensive discussion of Australia’s potential to be the food bowl for Asia. We agree that there is significant economic growth potential in agriculture and primary production. But we think that much of the discussion has glossed over where the largest opportunities lie, and what action is needed to realise them. Asia’s population is set to grow by some one billion people over the next thirty to forty years, an increase of 25%. More importantly, the Asian middle class will grow by around 2.5 billion people over this period, a six-fold increase. Forecasts suggest that Australia can feed only a very small proportion of these additional middle class mouths. So the real question is how to extract the most value from the country’s production, by targeting the most valuable consumers, rather than continuing a mindset inherited from Australia’s colonial past of mass producing and delivering to port. >>> Read the full article  How many record labels rejected The Beatles? How many publishers said ’no’ to Harry Potter? If the next Facebook walked into the Facebook boardroom, would Mark Zuckerburg and colleagues invest in the new pretender? Or would they think that the company was simply too speculative, too different, too risky? Remember, eight years later the original Facebook listed at a $100 billion valuation, having added an average of over 300,000 monthly active users a day since its launch in 2004. Revolutionary successes are by definition easy to see in hindsight, but how do you spot a business that will define a generation before it becomes great? Around the world, opportunities for dramatic and revolutionary change walk in and out of meeting rooms every day. Projects that offer a billion dollars of upside opportunity, with genuinely limited downside risks, are quietly rejected. Often the risks appear too great, or the vision is too far removed from where the perceived opportunities lie. Meanwhile, some CEOs and leadership teams are being criticised for a lack of boldness. With the benefit of hindsight, some business decisions that maintained the status quo have destroyed tens of billions of dollars of value. But, over the near term, evolution feels much safer than revolution. There are, of course, many ideas that succeeded in attracting investment, and then have slipped quietly into history without leaving any legacy. But how many truly great ideas or businesses or stories or bands have gone undiscovered, because they were too new, too different, or too far ahead of their time to resonate with those who had the opportunity to support them? The Fab Four, JK Rowling and Walt Disney all succeeded despite great scepticism, but this was down to a very small number of individuals who decided to back their judgement and try something completely new. Read on here... PS: Since this article was written, the Netpage technology was decommissioned, so you can no longer experience the excitement of print media that is truly interactive... For some of the lessons we've learned from this and the many other start-ups we've worked with, see "Entrepreneur or Gonetrepreneur" |

Pottinger PerspectivesOur take on issues that are changing the world, and how you can make the most of uncertainty Categories

All

|

|

We pay respect to Traditional Custodians and First Nations peoples everywhere, including the Gadigal People of the Eora Nation and the Lenape

|

RSS Feed

RSS Feed